For ultra-high-net-worth families, building a Single Family Office (SFO) can seem like the ultimate expression of control, privacy, and legacy stewardship. But for all its prestige, the cost of operating an SFO is steep and often surprisingly so. And for many families with less than $200M in assets, the economics may not make sense at all.

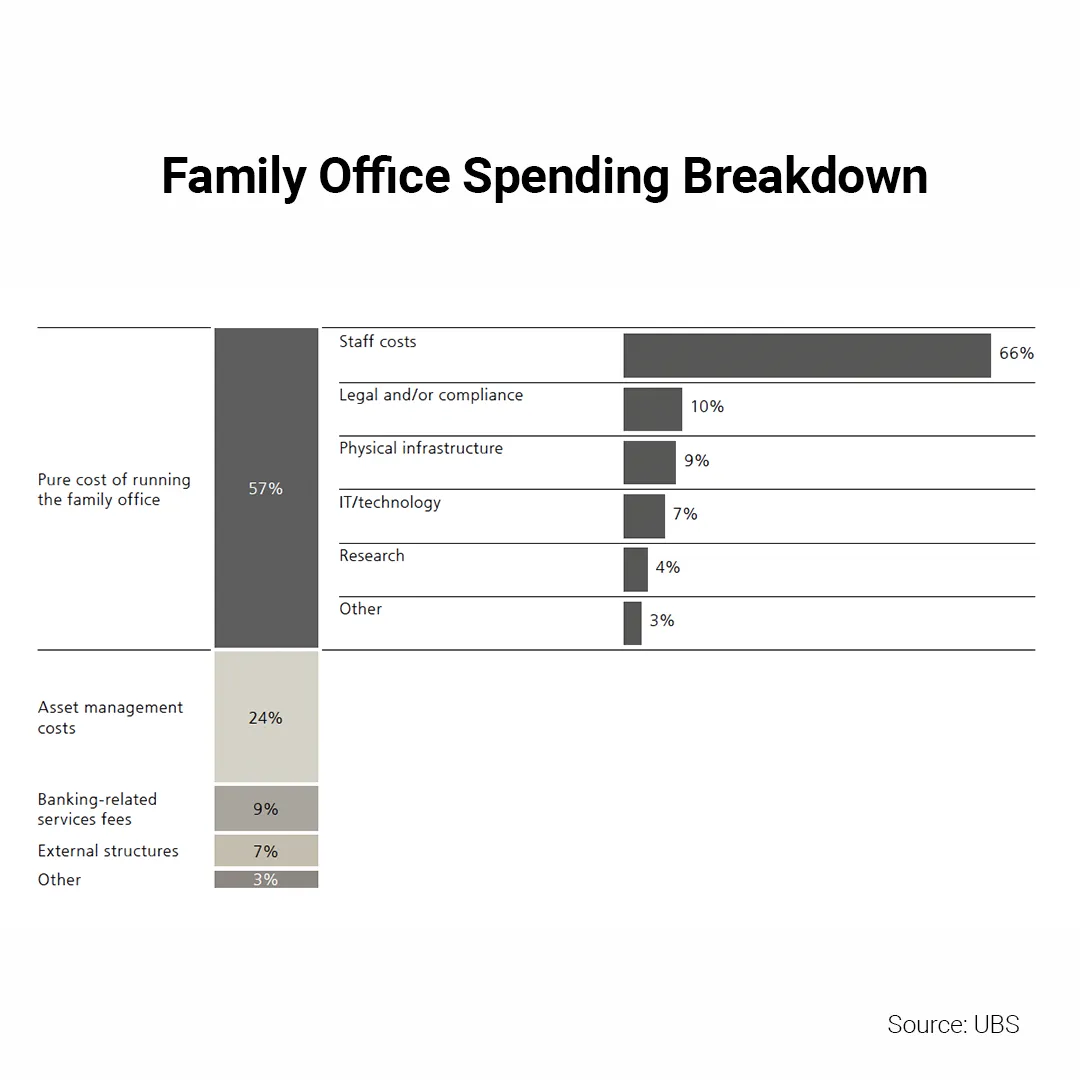

In this guide, I’ll break down the true cost of running a single-family office, drawing from 2024 reports by UBS and J.P. Morgan, as well as industry benchmarks. We'll also explore more agile models, like the hybrid model, that offer flexibility and control without the full-time overhead.

What Is a Single Family Office?

A single-family office is a private company set up to manage the financial and personal affairs of one wealthy family. Services typically include investment management, tax planning, estate strategy, reporting, concierge, and governance.

SFOs offer maximum control and customization. But that level of autonomy comes at a price.

The Major Cost Drivers of a Single Family Office

Data from J.P. Morgan and UBS reveals a consistent picture of cost categories:

1. Staffing & Salaries

This is often the largest expense.

- J.P. Morgan reports the average staff size is 11, but 50% of family offices operate with 5 or fewer people.

- Compensation for experienced CIOs or COOs can range from $300K to $1M+ annually, depending on location and responsibility.

- Support roles (analysts, tax pros, estate specialists, family education leads) quickly drive up costs.

Estimated cost: $1.5M–$4M+ annually for salaries, benefits, and incentives.

2. Investment Operations

Families that manage assets in-house need infrastructure:

- Trading platforms

- Performance reporting tools

- Custodian relationships

- Risk systems

For those using external managers, costs shift to advisory and due diligence fees.

Estimated cost: $500K–$2M+, depending on structure.

3. Legal, Tax, and Estate Planning

Depending on the size and complexity, SFOs may engage in-house or outside counsel for:

- Cross-border estate structures

- Complex tax filings

- Trust and entity management

These aren’t one-time services. Regulations evolve. So do family needs.

Estimated cost: $250K–$1M annually

4. Technology & Cybersecurity

Cybercrime is a growing concern. Nearly 25% of family offices have experienced a breach, yet 20% still have no cybersecurity in place.

- Secure communications

- Cloud storage

- Reporting platforms

- Penetration testing

- Vendor assessments

Estimated cost: $100K–$500K+ annually

5. Office Operations & Overhead

Think rent, HR compliance, insurance, licensing, board meetings, etc.

Estimated cost: $100K–$400K+

Total Average Annual Costs

According to J.P. Morgan’s 2024 report:

| Family Office Size (AUM) | Average Annual Cost | Median |

|---|---|---|

| $50M–$500M | $1.5M | $400K |

| $501M–$999M | $2.7M | $1.5M |

| $1B+ | $6.1M | $4.2M |

| Top Quartile (All Sizes) | $10M+ | — |

When a Single Family Office Doesn't Make Sense

SFOs offer maximum privacy and control, but there’s a threshold below which they become financially inefficient.

For families with $30M to $200M in assets, operating costs can eat up 3-5% of AUM annually, diminishing returns and constraining flexibility.

Let’s put that into context:

- At $50M in AUM, spending $1.5M/year = 3% of wealth annually

- That’s before any investment losses, taxes, or philanthropy

These families face a hard choice:

- Overpay for control

- Or sacrifice control for affordability

But there's a third path.

Hybrid Family Offices: The Middle Way

For families who value control but need cost efficiency, the hybrid model a compelling alternative.

Hybrid Family Office

- Core leadership in-house (e.g., CFO or family director)

- Outsourced investment, legal, tax, and tech services

- Flexible talent sourcing: fractional CIOs, project-based advisors

- Control over vision, leaner execution

- Built on secure digital platforms

- Best-in-class service providers managed by a family representative often the Operations Manager or Chief of Staff.

- Lower overhead, ideal for younger families or new wealth

Hybrid models can reduce costs to $300K–$900K annually, while maintaining professional-grade oversight and operational control.

Ask Before You Build

The desire for privacy, continuity, and family alignment is real. But a $3M–$10M annual burn rate isn't necessary. Before you start hiring staff or incorporating entities, ask yourself:

- Is control worth the fixed overhead?

- Can we achieve our goals with fewer permanent roles?

- How will our needs evolve over the next 10 years?

Many families overbuild too early, only to unwind years later.

If you’re a family with $30M to $150M in net assets, don’t assume the single family office is your only option. Today’s landscape offers flexible, tech-driven alternatives that give you control without the institutional drag.

Instead of asking “How do we build a family office?”

Start with: “What are we trying to solve for?”

Then build, strategically.

If your wealth has reached $30 million or more and you’re thinking about setting up a family office, or if your needs have outgrown a traditional wealth manager, schedule a strategy call with me to talk about your options.

Discussion